ATM Cash Withdrawal Tax in Pakistan 2025: Latest FBR Rates, Limits & Filers vs Non-Filers Guide

ATM Cash Withdrawal Tax in Pakistan

Every year, Pakistan apprises its tax laws, and in 2025 a major alteration affects how abundant tax non-filers pay when withdrawing cash from ATMs or bank branches. In this object, you’ll find a whole and easy clarification of the ATM cash withdrawal tax in Pakistan 2025 — who has to pay it, how abundant the tax is, what the limits are, with instances, exemptions, and what ladders you must take. After interpretation, you’ll have all the details you need and won’t need to look anywhere else.

ATM Cash Withdrawal Tax in Pakistan 2025

| Program / Rule | Start Date (Effective) | End Date / Validity | Amount / Rate | Application Method / Notes |

|---|---|---|---|---|

| Withholding Tax on Cash Withdrawals (non-filers) | July 1, 2025 (planned) | Until further notice | 0.8% on withdrawals above Rs 75,000/day | Automatic deduction by banks under Income Tax law |

| Exemption for Filers (ATL) | July 1, 2025 | Ongoing | 0% (no tax) | Applies automatically if name is on Active Taxpayers List (ATL) |

| Previous rule (for reference) | From Finance Act 2023 | Until 2025 changes | 0.6% on amounts above Rs 50,000/day (for non-filers) | Already in effect under Section 231AB |

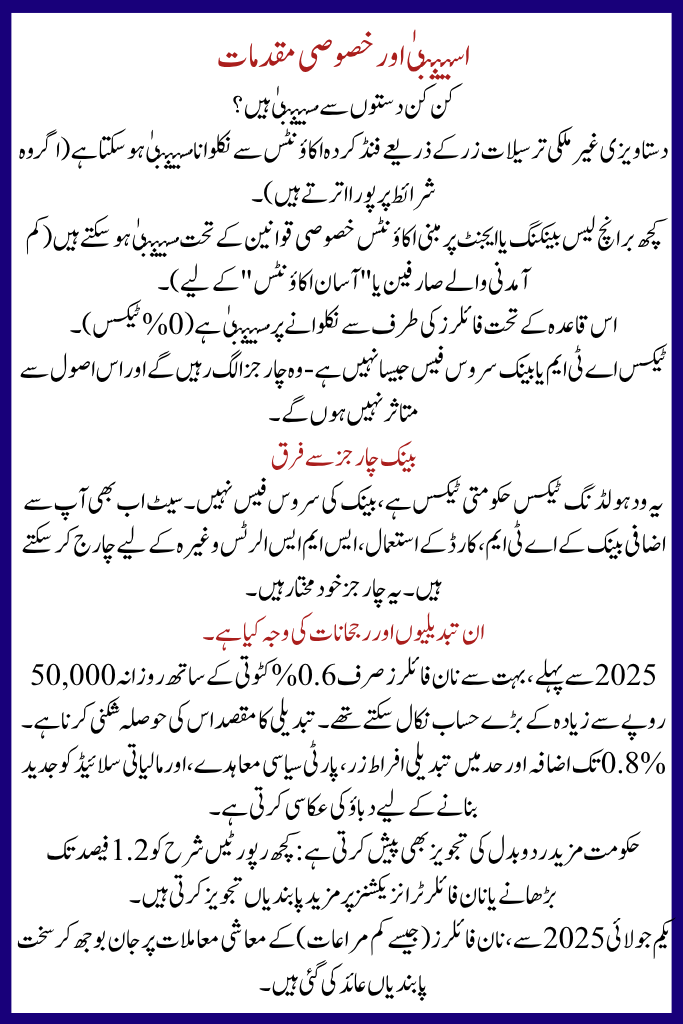

What Changed in ATM Cash Withdrawal Tax in Pakistan 2025?

New Withholding Tax Rate & Threshold

- In the 2025–26 Finance Bill, the government decided to raise the withholding tax rate for non-filers on cash withdrawals from 0.6% to 0.8%.

- Along with that, the threshold — the amount up to which withdrawals are tax-free — was increased from Rs 50,000/day to Rs 75,000/day for non-filers.

- This means that only the amount above Rs 75,000 in a day is taxed (if you are a non-filer).

- Filers (those whose names appear on the Active Taxpayers List, ATL) remain exempt from this withdrawal tax, i.e. 0% under this rule.

In short: non-filers pay 0.8% on amount over Rs 75,000 in one day; filers pay nothing under this rule.

Why These Changes ATM Cash Withdrawal Tax in Pakistan ?

- Broadening the tax base By making cash withdrawals costlier for non-filers, the government hopes more people will register as taxpayers (join ATL).

- Reducing untracked cash circulation Large cash withdrawals are harder to track; taxing them encourages use of formal banking and digital payments.

- Adjusting for inflation and revenue needs Raising the threshold from 50k to 75k gives relief to ordinary users, while increasing rate helps revenue collection.

How It Works: Filers vs Non-Filers

Status | Daily Threshold | Tax Rate | Who Pays

| Status | Daily Threshold | Tax Rate on excess | Who Pays |

|---|---|---|---|

| Filer (ATL) | Rs 75,000 | 0% | Does not pay withholding tax on cash withdrawals |

| Non-Filer | Rs 75,000 | 0.8% | Pays tax on the amount above Rs 75,000 in a day |

Example Illustrations

- If a non-filer withdraws Rs 100,000 in one day: Taxable part = 100,000 − 75,000 = 25,000 Tax = 0.8% × 25,000 = Rs 200

- If a filer withdraws Rs 120,000 in a day, there is no tax under this rule because filers are exempt.

Aggregation of Withdrawals

All cash extractions in a single day—whether from ATMs, bank counters, or through praise cards/cash withdrawals—are added together before examination against the brink. Even manifold small removals total.

More Read: CM Punjab GTS Programme Deadline 2025

Exemptions & Special Cases

What Withdrawals Are Exempt?

- Withdrawals from accounts funded by documented foreign remittances may be exempt (if they meet conditions).

- Some branchless banking or agent-based accounts might be exempt under special rules (for low income users or “Asaan Accounts”).

- Withdrawals by filers are exempt (0% tax) under this rule.

- The tax is not the same as ATM or bank service fees — those charges remain separate and unaffected by this rule.

Differences from Bank Charges

This withholding tax is government tax, not a bank’s service fee. Sets can still charge you for using additional bank’s ATM, card usage, SMS alerts, etc. Those charges are self-governing.

What Led to These Changes & Trends

- Before 2025, many non-filers could withdraw large calculations above Rs 50,000 daily with only 0.6% deduction; the change aims to discourage that.

- The increase to 0.8% and threshold change reflects inflation, party-political agreement, and a push to modernize financial slide.

- The government also proposes further vicissitudes: some reports suggest raising the rate to as high as 1.2%, or more restrictions on non-filer transactions.

- From July 1, 2025, stricter limitations are deliberate on economic dealings by non-filers (e.g. fewer privileges).

Risks & Impacts

For Non-Filers

- You pay extra cost when withdrawing large sums of cash.

- Your withdrawal behavior becomes traceable — your CNIC and account will be checked.

- There is greater incentive to become a filer (register with FBR).

For Filers

- You avoid this tax, which is one benefit of being on the ATL.

- Your financial transactions remain smoother in terms of withdrawal tax treatment.

Systemic / National Impact

- More discernibility into money flows and abridged informal cash cheap.

- Greater tax compliance and revenue for the government.

- Encouragement toward digital expenditures and investment use.

More Read: Punjab Extends Honhaar Scholarship Deadline

(FAQs)

What is the ATM cash withdrawal tax rate in 2025?

For non-filers, 0.8% on amounts withdrawn beyond Rs 75,000 per day. Filers are exempt under this rule.

Do all withdrawals in one day add up?

Yes — ATM + branch + card cash removals in a day are aggregated before smearing threshold.

Was the limit always Rs 75,000?

No — previously it was Rs 50,000. The increase was made in 2025 under the Finance Bill.

Is this the same as ATM fees?

No — this is a government tax. ATM usage fees or bank charges are separate and still may apply.

Is this the same as ATM fees?

No — this is a administration tax. ATM practice fees or bank charges are distinct and still may apply.

Can the tax rate rise further?

Yes, there are proposals to raise it to 1.2% or change the regime more strictly.

How can I avoid paying this tax?

Ensure your designation is on the ATL (i.e. become a filer). Use digital or card dealings below verge.

How to Become a Filer / Get on ATL

To enjoy exemptions and smoother banking:

- Visit the FBR website and list for NTN (if not already).

- File your income tax returns regularly.

- Ensure your status is Lively Taxpayer (ATL).

- Keep records and obey with tax law to uphold that status.

Being on ATL saves you from certain suppression taxes (like this withdrawal tax) and bounces you easier admission to financial facilities.

Conclusion

The 2025 changes to ATM Cash Withdrawal Tax in Pakistan aim to strike a balance: giving respite to regular account users by raising the threshold to Rs 75,000, while cumulative the tax rate for non-filers to 0.8% to push compliance. Filers remain excused under this rule, making contribution in the formal tax scheme more beneficial.

These changes reflect the government’s broader goals: plummeting informal cash flow, increasing visibility in fiscal dealings, and increasing the tax base. To avoid unnecessary costs and hassles, non-filers should strongly consider recording, filing proceeds, and touching to ATL status.

More Read: Islamabad Police New Online Learners Permit App