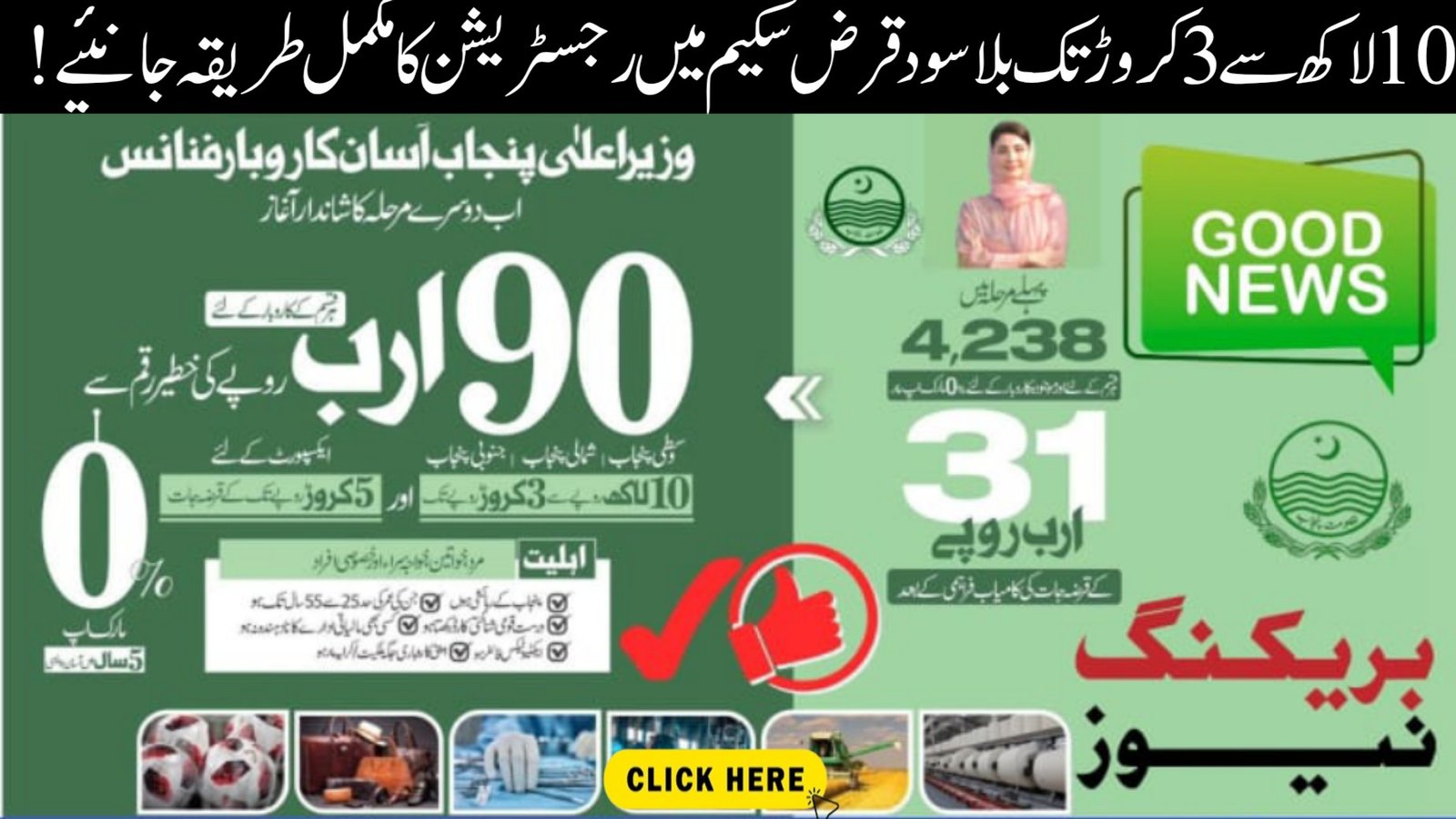

Breaking News: Assan Karobar Finance Scheme 2025 – Punjab Govt Launches Phase 2 Start

The Punjab Government has officially launched the Assan Karobar Finance Scheme 2025, marking the second phase of this flagship economic revival program. Designed to support small businesses, vendors, women, and youth, the scheme provides interest-free loans ranging from Rs 50,000 to Rs 10 lakh. Its main goal is to reduce unemployment, encourage entrepreneurship, and boost the provincial economy. With a transparent digital system, applicants can apply online and receive funds directly into their bank accounts, ensuring easy access to financial support without markup or corruption.

Key Features of Assan Karobar Finance Scheme 2025

| Category | Loan Amount | Target Beneficiaries |

|---|---|---|

| Small Startup Loan | Rs 50,000 – Rs 200,000 | Youth starting new businesses |

| Expansion Loan | Rs 200,000 – Rs 500,000 | Shopkeepers, vendors, SMEs |

| Growth Loan | Rs 500,000 – Rs 1,000,000 | Entrepreneurs & women-led enterprises |

| Interest Rate: 0% (markup fully paid by the Punjab Government) | ||

| Repayment: 2–3 years in easy installments | ||

| For complete details and to apply online, visit the official website: https://psic.punjab.gov.pk. |

Objectives of Assan Karobar Finance Scheme 2025

The objectives of Assan Karobar Finance Scheme 2025 are aimed at building financial independence for ordinary citizens. This scheme reduces poverty by supporting self-employment and small ventures. It empowers women, encourages youth entrepreneurship, and helps existing businesses grow. The Punjab Government has also emphasized rural development through this initiative. By making financial access easy and interest-free, the program supports sustainable economic growth and provides equal opportunities to all, especially those who cannot approach traditional banks due to markup burdens or strict requirements.

Loan Categories and Limits under Assan Karobar Finance Scheme 2025

The loan categories in Assan Karobar Finance Scheme 2025 allow citizens from various backgrounds to apply based on their needs.

-

Small Startup Loan: Rs 50,000 – Rs 200,000 for youth launching businesses

-

Expansion Loan: Rs 200,000 – Rs 500,000 for shopkeepers and small vendors

-

Growth Loan: Rs 500,000 – Rs 1,000,000 for SMEs and women entrepreneurs

Each slab ensures flexibility with 2–3 year repayment schedules. This tiered design provides a chance for both small traders and ambitious entrepreneurs to achieve their financial goals under the government-backed interest-free system.

Eligibility Criteria for Assan Karobar Finance Scheme 2025

The eligibility criteria for Assan Karobar Finance Scheme 2025 are simple and inclusive. Applicants must be residents of Punjab holding a valid CNIC. The age requirement is between 20 and 50 years, and applicants must provide a small business idea or income-generating plan. The government prioritizes youth, women, differently-abled individuals, and small vendors to maximize outreach. Applicants must also confirm they are not defaulters of any bank or financial institution. These fair rules make the scheme widely accessible for deserving families across Punjab.

Required Documents for Assan Karobar Finance Scheme 2025

Applicants must arrange the following documents to apply for the Assan Karobar Finance Scheme 2025:

-

Copy of valid CNIC

-

Proof of residence such as a utility bill or rental agreement

-

One-page business plan or idea

-

Two guarantors (for higher loan amounts)

-

Bank account details for disbursement

The Punjab Government has simplified the process by keeping documentation minimal. Even individuals from rural areas with limited education can easily prepare these documents and apply. This ease of access makes the program truly inclusive and citizen-friendly.

Application Process for Assan Karobar Finance Scheme 2025

The application process for Assan Karobar Finance Scheme 2025 is fully online and corruption-free. Applicants must register at the official Punjab Government portal, submit their details, and upload required documents. NADRA verifies CNICs, and officials review business plans and guarantors. Once the application is approved, the funds are directly transferred into the applicant’s bank account. Confirmation is sent through SMS and email. This digital approach ensures fairness, prevents delays, and eliminates the role of middlemen, making the scheme transparent and reliable for all applicants.

Economic Impact of Assan Karobar Finance Scheme 2025

The economic impact of Assan Karobar Finance Scheme 2025 will significantly benefit Punjab’s economy. By supporting small enterprises, the scheme creates jobs, empowers women, and helps rural families achieve financial stability. It reduces unemployment by promoting self-employment and encourages youth to become entrepreneurs. With thousands of new businesses expected to emerge, local economies will grow stronger. This initiative also spreads financial inclusion to areas previously ignored by banks, creating long-term economic opportunities across Punjab and ensuring equal growth for urban and rural communities.

Conclusion

The Assan Karobar Finance Scheme 2025 is a groundbreaking step by the Punjab Government to promote entrepreneurship, support small businesses, and fight unemployment. Through interest-free loans, transparent digital applications, and wide eligibility coverage, it offers thousands of people the chance to build a secure future. In this article, we are sharing all the details about objectives, loan categories, eligibility, required documents, application process, and economic impact. If you are planning to start or expand your business in 2025, this program is your golden chance for success.

FAQs

1. Is the Assan Karobar Finance Scheme 2025 only for Punjab residents?

Yes, only citizens with a Punjab domicile and valid CNIC can apply.

2. What is the maximum loan amount in this scheme?

The maximum loan amount is Rs 1,000,000 depending on business needs.

3. Do all loans require guarantors?

No, only larger loans require guarantors, while smaller loans can be approved without them.

4. How will applicants receive the loan amount?

Approved funds will be transferred directly to the applicant’s bank account after verification.