Chief Minister Punjab Loan Scheme 2025 Interest-free or low-interest business loans from PKR 100,000 to PKR 5 million for all types of businesses

Chief Minister Punjab Loan Scheme 2025

The CM Punjab Loan Scheme 2025 is a newly launched initiative by the Punjab government to support youth, women, and aspiring entrepreneurs across the province. Through this scheme, individuals can apply for interest-free or low-interest business loans ranging from PKR 100,000 to PKR 5 million, depending on their business type and category.

Overview of CM Punjab Loan Scheme 2025

| Feature | Details |

|---|---|

| Loan Range | PKR 100,000 – PKR 5,000,000 |

| Interest Rate | 0% to 5% (based on applicant category) |

| Repayment Period | Up to 5 years |

| Eligibility | Punjab residents aged 18–50 with a valid CNIC |

| Target Groups | Youth, women, SMEs, differently-abled individuals |

| Application Mode | Online via official portal |

| Application Deadline | 31st March 2025 |

| Official Website | punjab.gov.pk/loan2025 (Official Site) |

Why This Loan Scheme Matters

The CM Punjab Loan Scheme 2025 empowers residents to build and grow their own businesses. It addresses common financing barriers faced by youth and women by offering collateral-free loans, simple application procedures, and priority processing for underrepresented groups.

Also read : HEC Need Based Scholarship 2025 Apply NowSchema:

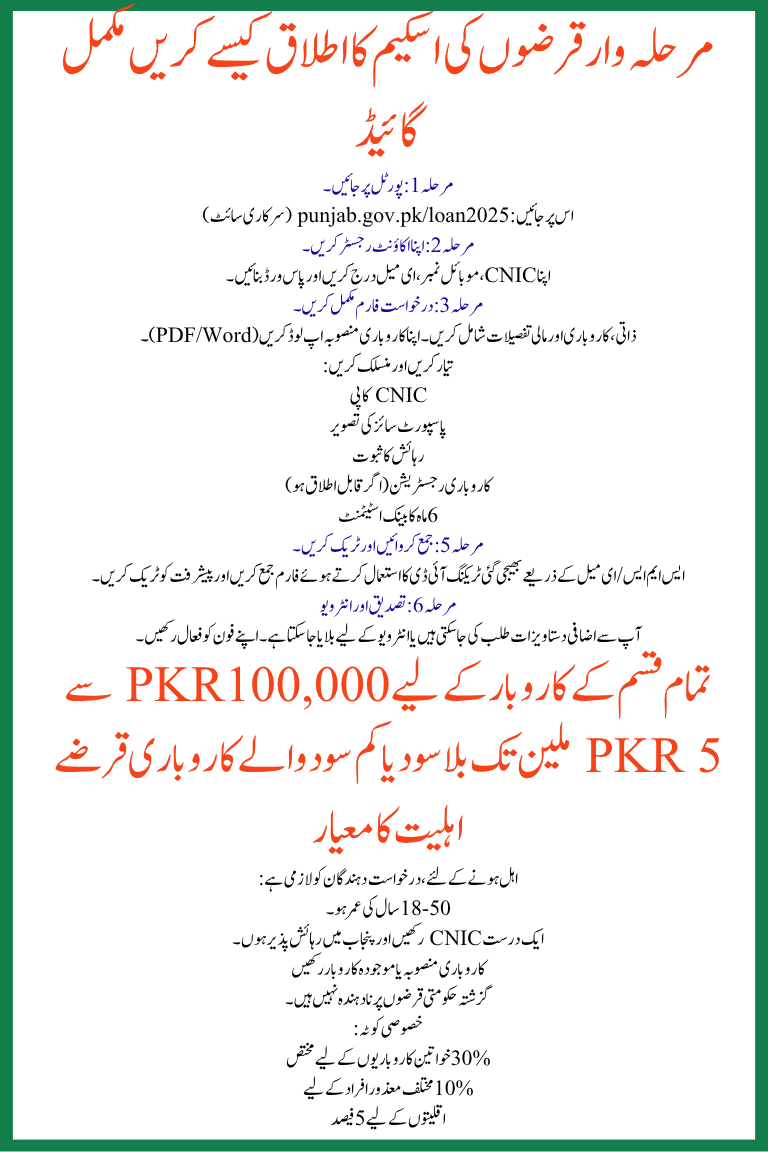

Interest-free or low-interest business loans from PKR 100,000 to PKR 5 million for all types of businesses Eligibility Criteria

To qualify, applicants must:

- Be 18–50 years old

- Hold a valid CNIC and reside in Punjab

- Have a business plan or an existing business

- Not have defaulted on previous government loans

Special Quotas:

- 30% reserved for women entrepreneurs

- 10% for differently-abled individuals

- 5% for minorities

Loan Categories & Interest Rates

- Micro Loans (PKR 100,000 – 500,000)

For startups, freelancers, or home-based businesses

→ 0% interest for women and differently-abled individuals - Small Business Loans (PKR 500,001 – 2,000,000)

For small registered businesses

→ 3% interest for youth and startups - Medium Enterprise Loans (PKR 2,000,001 – 5,000,000)

For expanding established businesses

→ 5% interest rate

How to Apply Step-by-Step Loans scheme complete Guide

Step 1: Visit the Portal

Go to: punjab.gov.pk/loan2025 (official site)

Step 2: Register Your Account

Enter your CNIC, mobile number, email, and create a password.

Step 3: Complete Application Form

Add personal, business, and financial details. Upload your business plan (PDF/Word).

Step 4: Upload Documents

Prepare and attach:

- CNIC copy

- Passport-size photo

- Proof of residence

- Business registration (if applicable)

- 6-month bank statement

Step 5: Submit & Track

Submit the form and track progress using the tracking ID sent via SMS/email.

Step 6: Verification & Interview

You may be asked for additional documents or called for an interview. Keep your phone active.

Also read : BISP Web Portal October 2025 Update

FAQs

Who can apply?

Any Punjab resident aged 18–50 with a valid CNIC and a viable business plan.

How to apply online?

Register at the official portal, fill out the application, upload documents, and submit.

What is the max loan amount?

Up to PKR 5,000,000, depending on the business type and need.

Is collateral required?

Not for loans under PKR 500,000. Higher loans may require extra documentation.

Conclusion

The CM Punjab Loan Scheme 2025 is more than just financial support—it’s a step toward self-reliance and empowerment. With inclusive policies, easy online access, and strong government backing, this is the perfect time to turn your business ideas into reality. Apply early, submit a strong plan, and make the most of this opportunity.