Current News: Ehsaas Naujawan Program 2025: Today Check Application Status & Full Guide October 2025

Ehsaas Naujawan Program 2025

The Ehsaas Naujawan Program 2025 is a adolescence authorization initiative through the Khyber Pakhtunkhwa (KP) government. Under this scheme, interest-free loans are accessible to young businesspersons, students, and skilled workers so they can start or expand trades, build skills, and help uplift their groups. With a total allocation of PKR 1.4 billion then a high endorsement rate, it’s among the most nearby youth programs in KP nowadays.

Below is a quick summary table of the key features, followed by detailed explanations, step by step.

Ehsaas Naujawan Program 2025

| Feature | Detail |

|---|---|

| Total Budget | PKR 1.4 billion (for the program) |

| Applications Received | 21,814 (as reported in official data) |

| Applications Approved | 4,983 |

| Loans Distributed | 4,887 youth (worth ~ PKR 1.3 billion) |

| Approval Rate | ≈ 93% |

| District Coverage | 4,666 from KP, 317 from FATA / merged districts |

| Application / Status Method | Online (via portal / Bank of Khyber / Akhuwat partners) |

What is Ehsaas Naujawan Program 2025?

The Ehsaas Naujawan Program (also spelled Nojawan) is a prize youth loan arrangement launched by the KP government to provide interest-free or low-cost loans to young folks in the area. The program is part of the broader Ehsaas / Ihsas Initiative to reduce poverty, boost free enterprise, and authorize youth in KP.

Under this scheme, loans are if for business ventures, skill-based projects, or increasing current setups. The program is designed to be nearby, youth friendly, and comprehensive, with singular quotas for women, persons with incapacities, and merged regions.

More Read: HEC Need Based Scholarship 2025 Apply Now

Application Status 2025: Key Statistics

Applications & Approvals

- A total of 21,814 applications were received under the scheme in its current cycle.

- Out of those, 4,983 applications were approved.

- Loans worth ≈ PKR 1.3 billion have been disbursed to 4,887 youth.

- The approval rate is approximately 93%, reflecting a high acceptance relative to submissions.

- Geographically, 4,666 approved applications were from KP, and 317 from FATA / merged districts.

These figures indicate serious government commitment and responsiveness to youth demands.

Why Is the Approval Ratio High (93%)?

A 93% approval rate is unusually high for a loan scheme. Key reasons are:

- The package is intentionally streamlined to reduce government and delays.

- Many checks/eligibility filters are applied at pre-screening, so only fit requests proceed.

- The use of digital verification, partner banks, and automated tools helps haste up approval.

- The portal or partner institutions may impose strict initial rules so that weak requests are filtered early.

- Quota and regional targets ensure balanced distribution, so not all rejections come from unique area

Because of this design, applicants who follow requirements and submit clean documents often get approved.

Who Can Apply? Eligibility Criteria

To be eligible, candidates must encounter certain criteria. The particulars vary depending on which “component” of the package (Bank of Khyber, Akhuwat, cluster vs single) they smear in.

Common Requirements

- Be a resident of Khyber Pakhtunkhwa (or merged districts) and hold a valid CNIC.

- Age limits: for many loans, 18 to 35 years for cluster/business group model; for some small scale, up to 40 years.

- Submit a viable business plan or proposal showing how the loan will be used.

- Clean credit history or no heavy defaults (depending on partner institution).

- For cluster loans: groups/clusters of 3 to 5 youth often required.

Loan Components – Differences

The program is split into two major components, often run through Bank of Khyber (BoK) and Akhuwat Islamic Microfinance.

| Component | Loan Range / Scale | Target / Structure |

|---|---|---|

| BoK / Cluster Model | PKR 1 million to PKR 5 million | Groups or cluster of 3–5 youth |

| Akhuwat / Small Loans | PKR 100,000 to 500,000 | Individual small business loans |

Also, there is a grace period before repayment starts. For BoK clusters, there is an 8-year repayment schedule with about 20 months grace period (no repayment first).

Benefits & Features of Ehsaas Naujawan

Financial Empowerment

You get interest-free or very subsidized loans to start or scale up businesses, giving youth a push to become self-sufficient. (The

Skill Utilization & Entrepreneurship

Talented youth with technical or trade skills can turn ideas into businesses using the funding and guidance structure. The program encourages youth to play an active role in local economies.

Equal Access & Quotas

Special quotas are reserved for women, persons with disabilities, minorities, and those from merged districts or underdeveloped areas.

Flexible Repayment & Grace Period

Beneficiaries get initial months without repayment (grace) and long repayment windows to ease burden.

Integration With Vision 2025 & Youth Policy

The program contributes to wider goals of job creation, economic development, lack reduction, and youth contribution in KP’s growth. By subsidy youth plans and businesses, the administration aims to build a maintainable, comprehensive economy.

More Read: Punjab E-Taxi Scheme 2025 – Apply Online Through e-taxi.punjab.gov.pk

How to Apply & Check Application Status in 2025

Here is the step-by-step process and how to track your status.

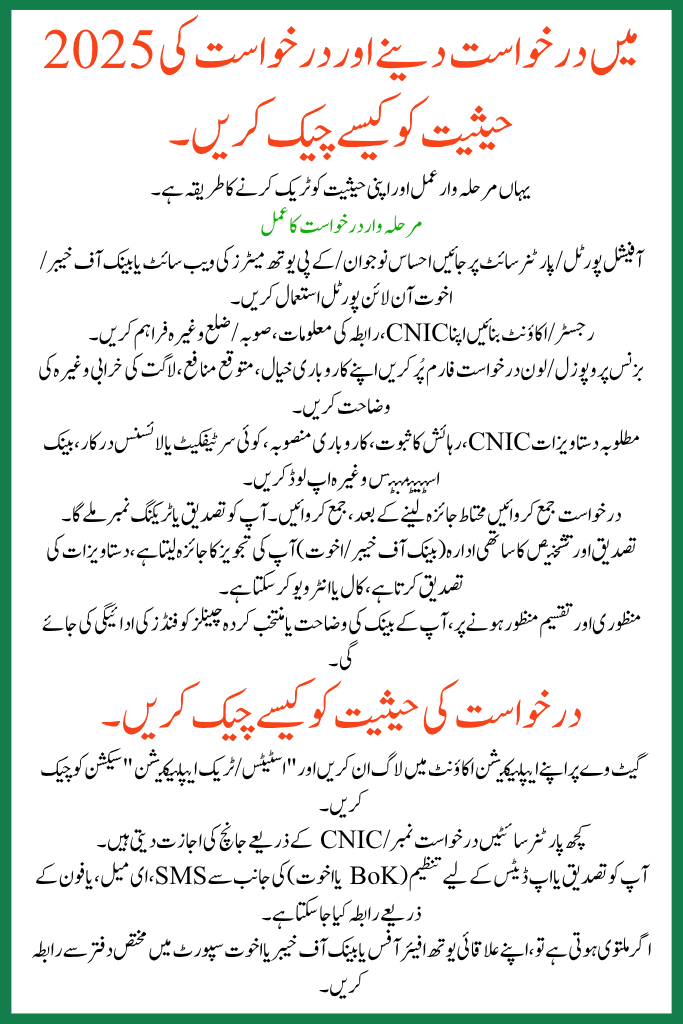

Step-by-Step Application Process

- Visit official portal / partner site Use the Ehsaas Naujawan / KP Youth Matters website or Bank of Khyber / Akhuwat online portals.

- Register / Create Account Provide your CNIC, contact info, province/district, etc.

- Fill Business Proposal / Loan Application Form Describe your business idea, projected profits, cost breakdown, etc.

- Upload Required Documents CNIC, proof of residence, business plan, any certificates or licenses needed, bank statements, etc.

- Submit Application After careful review, submit. You will receive a confirmation or tracking number.

- Verification & Evaluation Partner institution (Bank of Khyber / Akhuwat) reviews your proposal, verifies documents, may call or interview.

- Approval & Disbursement If approved, funds will be paid to your bank explanation or finished chosen channels.

How to Check Application Status

- Log into your application account on the gateway and check “Status / Track Application” section.

- Some partner sites allow checking via application number / CNIC.

- You may be communicated via SMS, email, or phone from the organization (BoK or Akhuwat) for confirmation or updates.

- If postponements occur, contact your region youth affairs office or the allocated office in Bank of Khyber or Akhuwat support.

Real Challenges & Tips to Increase Acceptance Chances

Common Challenges

- Portal excess or downtime when limits approach

- Incomplete or low quality document uploads

- Weak business tactics or lacking predictable revenue models

- Incongruities in data (name, CNIC, address)

- Late proposals

Tips to Improve Success

- Prepare and polish your commercial plan in advance

- Upload high quality, clear pamphlets (scans, not photos)

- Follow format specifications strictly (file types, sizes)

- Submit earlier, don’t wait for last days

- Use the same spelling, name order as your CNIC

- Keep proof of submission and screenshot the approval

- Respond rapidly when spouse organization requests additional confirmation

More Read: Good News:BISP 8171 Campsite: Complete Details for October

Impact & Significance for KP Youth

This scheme is transformative for KP’s youth scenery. It shifts youth after being job-seekers to job-creators. The injection of nearly PKR 1.3 billion into young hands, across rural and urban settings, signals serious investment in future human capital. The high endorsement rate builds faith and encourages additional requests in later cycles.

Over time, successful microcomputer and small initiatives built with these loans will make jobs for others, boost local frugalities, and reduce youth migration out of rural parts. The program too supports communal equity by reaching relegated collections and compound regions.

Conclusion

The Ehsaas Naujawan Program 2025 is a bold step by the KP administration to authorize its youth finished accessible, interest-free credits. With over 21,000 applications, closely 5,000 endorsements, and PKR 1.3 billion disbursed, it’s delivering real results. If you succeed, carefully follow the request steps, submit strong proposals, and screen your request position online.

This package is more than funding — it’s a vision to build a group of entrepreneurs, reinforce the cheap, and give KP’s youth the tools to prosper. Be active, apply early, and convert your future.

FAQ (Frequently Asked Questions)

Who can apply for Ehsaas Naujawan?

Residents of KP (or merged districts) aged 18–35 (or up to 40 in some cases), with a viable commercial proposal and valid leaflets.

How much loan amount can I get?

For cluster/BoK model: PKR 1 million to 5 million. For Akhuwat model: PKR 100,000 to 500,000.

Is the loan interest-free?

Yes, the program is intended to be interest-free or low-cost to ease refund burden.

What is the repayment schedule?

For cluster advances (BoK): 8-year schedule with ~20 months grace period. For Akhuwat small advances: terms attuned depending on scheme.

How will I know if my application is approved?

You’ll be informed via SMS, correspondence, or portal status. Wife institution may communication you for confirmation.