PM Youth Loan Program Apply Online Eligibility complete update 2025

PM Youth Loan Program

The PM Youth Loan Program 2025 is Pakistan’s renewed effort to support young entrepreneurs, students, and job-seekers by giving them easy access to capital. With an updated higher ceiling, reduced markup, streamlined digital process, and priority for women and rural applicants—it’s set to become more inclusive and impactful.

Also Read: Maryam Nawaz Issues Strong Warning to Sindh Leaders

What’s PM Youth Loan Program

New in 2025?

- The loan ceiling under the Youth Program has been raised from PKR 500,000 to PKR 1,500,000 for small businesses.

- The government has directed banks to approve applications within 30 working days.

- A digital application portal has been upgraded to allow real-time tracking of your application.

- Special quotas and preferences remain in place for women, differently-abled persons, and rural applicants.

- The scheme is being extended to business, agriculture, IT, e‑commerce ventures under one umbrella, making it broader in scope.

Loan Tiers & Markup (2025)

Below is a sample structure based on the available reports. (Note: Some specifics may vary depending on the implementing bank or region.)

| Tier | Loan Amount | Markup / Interest | Repayment Period |

|---|---|---|---|

| Tier 1 | Up to PKR 0.5 million | 0% (interest-free) | 3–5 years |

| Tier 2 | PKR 0.5 million to 1.5 million | 5% | 5–7 years |

| Tier 3 | PKR 1.5 million to 7.5 million (in some versions) | 7% | 7–8 years |

Note: There have been some claims in media of further expansions in loan limits (e.g. up to PKR 7.5 million) or extra categories (like laptop financing or overseas worker loans) in 2025.

However, these aren’t confirmed in official statements broadly, so treat them cautiously.

Also Read: pave.gov.pk | 30th September 2025 PM Electric Bike Scheme

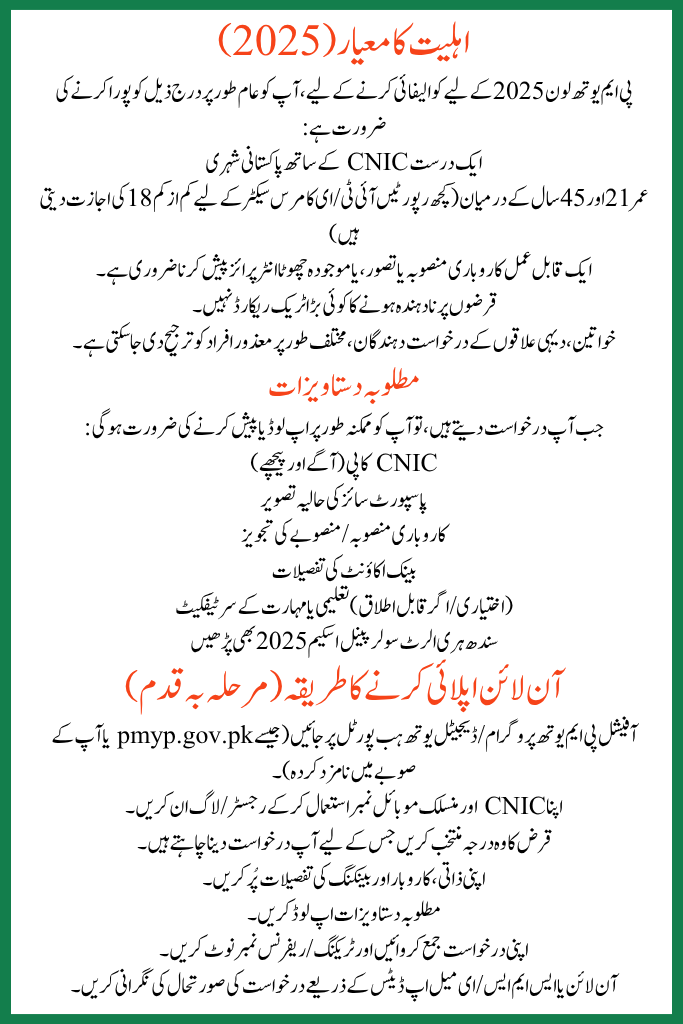

Eligibility Criteria (2025)

To qualify for the PM Youth Loan 2025, you generally need to satisfy the following:

- Pakistani citizen with a valid CNIC

- Age between 21 and 45 years (some reports allow minimum 18 for IT / e‑commerce sector)

- Must present a viable business plan or concept, or existing small enterprise

- No major track record of defaulting on loans

- Preference may be given to women, rural area applicants, differently-abled

Required Documents

When you apply, you’ll likely need to upload or present:

- CNIC copy (front & back)

- Recent passport‑size photograph

- Business plan / project proposal

- Bank account details

- (Optional/if applicable) educational or skills certificates

How to Apply Online (Step‑by‑Step)

- Go to the official PM Youth Program / Digital Youth Hub portal (e.g.,

pmyp.gov.pkor as designated in your province). - Register / log in using your CNIC and linked mobile number

- Choose the loan tier you want to apply for

- Fill in your personal, business, and banking details

- Upload the required documents

- Submit your application and note the tracking / reference number

- Monitor the application status online or via SMS/email updates

Also Read: Govt Official Portal pave.gov.pk Online Registration

What Happens After You Apply in PM Youth Loan Program

- The bank / relevant authority will verify your documents, business plan, and creditworthiness

- A decision is expected within 30 working days (as per 2025 directive)

- Upon approval, the loan amount will be disbursed to your bank account or to vendors (in case of purchases)

- You begin repayment (monthly or quarterly) according to your chosen schedule

Tips & Warnings

- Always use the official portal — there is no legitimate fee for applying

- Keep all screenshots / application reference numbers as proof

- Make sure your business plan is clear, feasible, and realistic

- Don’t overstate your capacity or income — it may harm your credibility

- If your application is delayed, reach out to your bank or the youth program’s heling i